Hold onto your hats, folks—this isn’t your grandma’s balance sheet anymore. We’re talking about a company that’s laser-focused on turning digital gold into its secret sauce for growth. As of this writing, GPUS shares are trading around $0.30–$0.35 amid a wild week, but that Bitcoin stash? It’s the real MVP here, blending AI data center muscle with crypto savvy in a way that’s got Wall Street buzzing. And with BTC’s recent dip to around $86,000, it only amps up the drama—Ault’s calling volatility the ultimate buying opportunity.

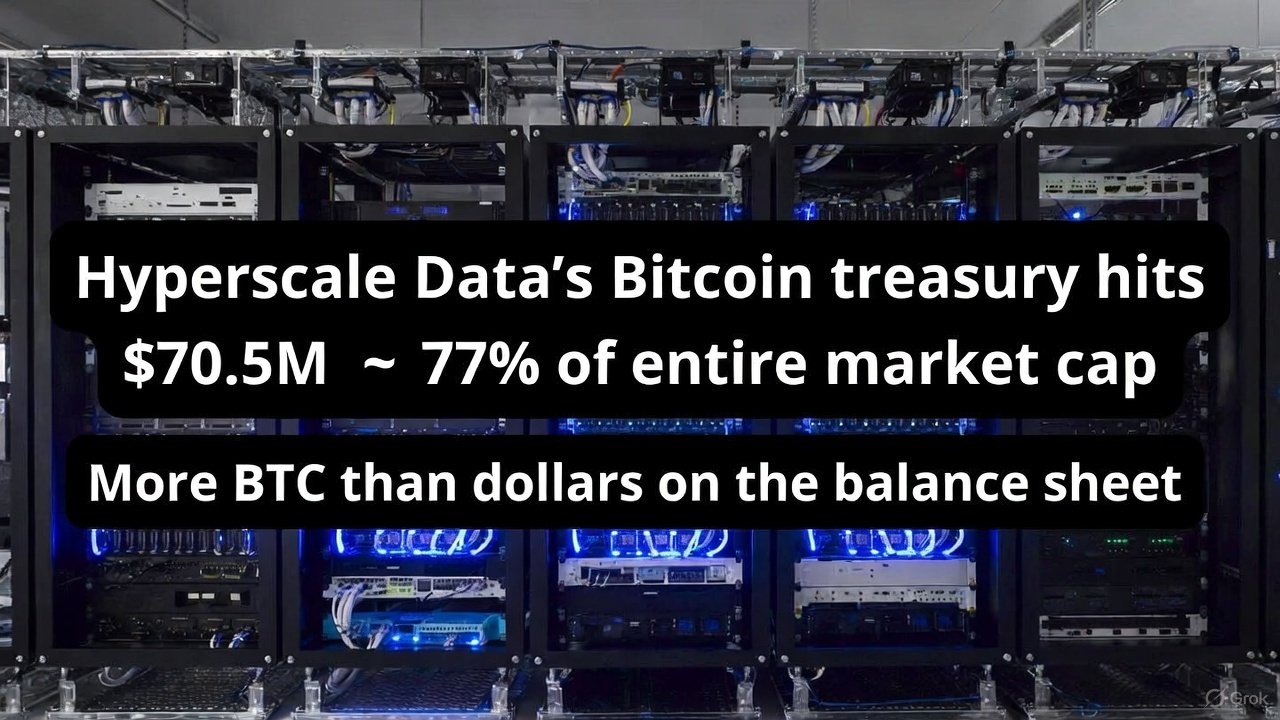

= 77% of Market Cap

Let’s rewind a bit. Hyperscale Data, once a diversified player in defense tech and lending, has pivoted hard into the future. Picture this: a Las Vegas-based powerhouse owning data centers humming with NVIDIA GPUs for AI workloads, while its mining arm, Sentinum, cranks out Bitcoin like it’s going out of style. Founded back in 1969 by the bold Milton “Todd” Ault III, this crew’s been around the block, but their latest move? It’s pure rocket fuel.

The announcement dropped like a mic on November 25, 2025, via PR Newswire: Hyperscale’s treasury now packs 382.9384 BTC straight from mining ops, plus $37.25 million in cash earmarked for more buys. That’s dollar-cost averaging on steroids, folks—snapping up BTC during dips to build toward a $100 million target. “We’re extremely committed,” beamed Ault in the release. “This strategy positions us at the crossroads of digital infrastructure and asset innovation.”

Why does this matter? In a world where inflation’s lurking like a bad sequel, Bitcoin’s fixed supply makes it the ultimate hedge. Hyperscale isn’t just holding; they’re mining it, pairing it with AI clouds in Michigan that could power the next big tech boom. Remember how we broke down MicroStrategy’s Bitcoin playbook last year? This feels like the sequel, but with more GPUs and grit. And for those eyeing Solana’s staking frenzy, check our deep dive on corporate Solana moves—it’s all connecting the dots in crypto adoption.

How the Market Reacted When Others Did This

Flashback to 2020: MicroStrategy drops $425 million on BTC, and boom—their stock catapults over 440% in the bull run, turning a software firm into a crypto proxy. Fast-forward to Tesla’s $1.5 billion splash in early ’21; shares spiked 10% overnight, but volatility hit hard when Elon flirted with sales, dipping 20% in weeks. The lesson? Bold treasury bets can ignite rallies, but they’re not for the faint-hearted—expect 2-3x swings tied to BTC’s mood swings.

Enter Hyperscale: Post-announcement, GPUS saw a quick 5% pop before settling amid broader market jitters. With BTC crashing below $86,000 this morning before rebounding to $90,000+ as of this writing, that $70.5 million pile (up 312% in holdings since October!) is flexing serious muscle. Analysts whisper this could mirror Metaplanet’s Japan-fueled surge, where shares doubled on similar treasury news. But hey, it’s volatile—beta at 2.6 means buckle up, especially with the dip highlighting Ault’s view that volatility’s not a bug, but a feature for stacking sats cheaper.

The Bigger Picture: Why Corporate Crypto Is the New Normal

Over 150 public companies now hoard more than 1.6 million BTC, per recent tallies— that’s billions in boardroom bets. From Tesla’s steady 11,500 BTC grip to MARA’s mining mania, it’s clear: crypto treasuries aren’t fringe anymore. They’re firepower against fiat fade, diversification dynamite, and a badge of innovation. Hyperscale’s play? It’s schooling the suits on blending Bitcoin with AI to supercharge data centers that could underpin tomorrow’s economy.

Challenges ahead? Sure—regulatory curveballs and price rollercoasters keep execs up at night. But with weekly updates locked in and debt slashed by $30 million recently, Hyperscale’s building a fortress. As Ault puts it, volatility’s not a bug; it’s the feature letting them stack sats cheaper, like today’s dip turning that $37.25 million cash pile into even more firepower.

Bottom line: This $70.5 million milestone isn’t just numbers—it’s a battle cry for corporate evolution. Keep watching GPUS; in the crypto treasury arena, they’re not playing defense. They’re rewriting the rules, one block at a time.

Disclosure: As of this writing, prices and values are subject to market fluctuations. Always DYOR.