In an era of economic uncertainty, corporations are increasingly turning to cryptocurrencies as a strategic asset class for their treasuries. With Bitcoin reaching historic highs and Ethereum offering yield-generating opportunities, building a corporate crypto treasury has evolved from a niche experiment to a mainstream financial strategy. This comprehensive guide explores why companies are adopting crypto, the step-by-step process to implement it, real-world examples, and essential tips for executives. Whether you’re a CFO looking to diversify your balance sheet or a business leader hedging against inflation, this resource provides actionable insights backed by the latest 2025 data.

- Why Companies Are Adopting Crypto for Their Treasuries

- Step-by-Step Guide to Implementing a Corporate Crypto Treasury

- 1. Assess Regulatory Compliance

- 2. Select the Right Crypto Assets

- 3. Set Up Wallets and Security Measures

- 4. Adhere to Accounting Standards

- 5. Integrate with Traditional Finance Tools

- Real-World Examples of Corporate Crypto Treasuries

- Insights from Treasury Experts

- Checklist for Executives: Getting Started

- Future-Proofing Your Crypto Treasury

Why Companies Are Adopting Crypto for Their Treasuries

The adoption of cryptocurrencies in corporate treasuries has surged in 2025, driven by a confluence of economic factors and technological advancements. According to recent surveys, 15% of North American CFOs are considering non-stable cryptocurrencies for their investment portfolios, highlighting a shift toward digital assets as a viable alternative to traditional holdings.

Inflation Hedging: With persistent inflation eroding the value of fiat currencies, cryptocurrencies like Bitcoin serve as a “digital gold.” Midmarket private firms are allocating portions of their cash reserves to Bitcoin to hedge against inflation and geopolitical risks. For instance, as the U.S. dollar weakens amid global tensions, Bitcoin’s fixed supply (capped at 21 million coins) provides a scarcity-driven hedge.

Portfolio Diversification: Traditional treasuries often rely on bonds, stocks, and cash equivalents, but crypto offers uncorrelated returns. Holding cryptoassets supports diversification, balance sheet optimization, and direct exposure to the digital asset economy. Ethereum, in particular, allows for yield generation through staking, turning idle assets into income streams.

Balance Sheet Optimization and Yield: Institutions now hold over $40 billion in ETH, leveraging it for liquidity and yields. Bitcoin treasury companies are seeing outsize returns in rising markets, with specialized firms buying 1,400 BTC daily, accounting for 76% of business purchases fueled by over $100 billion in investor inflows.

Institutional Momentum: The convergence of treasury companies, ETF expansion, and consumer application growth is reshaping cryptocurrency adoption. Companies recognize Bitcoin’s potential for appreciation, with further diversification expected as more firms adopt it.

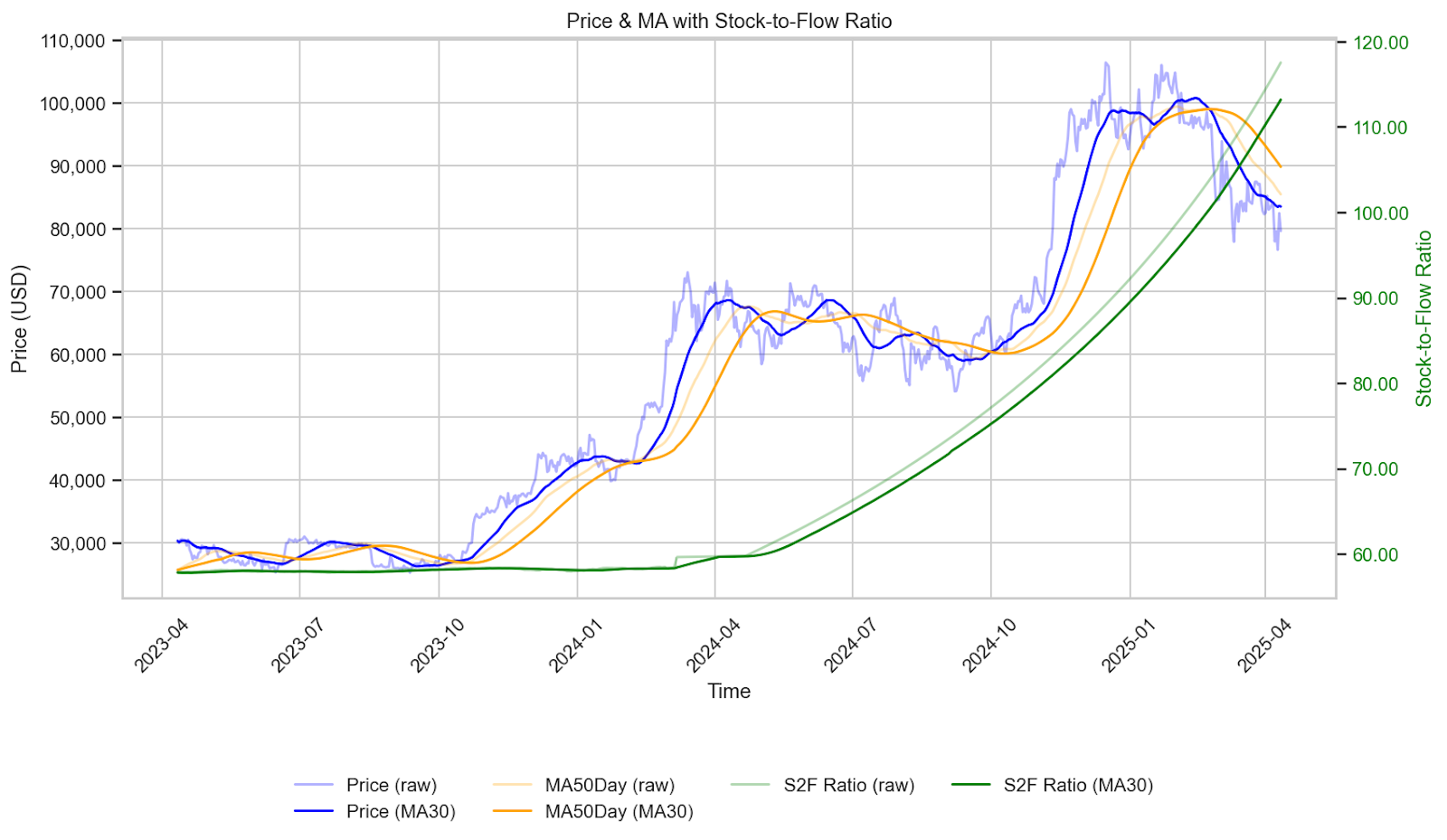

To illustrate the volatility inherent in crypto markets—which can be both a risk and an opportunity—consider the following chart showing Bitcoin’s price and stock-to-flow ratio trends through 2025:

Source: Amberdata Blog – Bitcoin Q1 2025: Historic Highs, Volatility, and Institutional Moves

This chart demonstrates how Bitcoin’s price (blue line) has trended upward, often correlating with its stock-to-flow ratio (green line), a model emphasizing scarcity. However, volatility remains a key consideration, with annualized realized volatility fluctuating significantly.

Step-by-Step Guide to Implementing a Corporate Crypto Treasury

Building a crypto treasury requires a disciplined approach, balancing innovation with risk management. Below, we outline the key steps based on expert recommendations and best practices from 2025.

1. Assess Regulatory Compliance

Compliance is the foundation of any crypto treasury strategy. In the U.S., 2025 has seen significant regulatory advancements, including the GENIUS Act, which establishes a federal framework for stablecoins and encourages innovation while ensuring consumer protection.

Key considerations include:

- Stablecoin Regulations: Issuers must maintain 100% reserves in high-quality liquid assets like cash or short-term U.S. Treasuries.

- Risk Management: Agencies like the OCC have issued joint statements on crypto-asset safekeeping, emphasizing existing principles for banks.

- Global Coordination: While the GENIUS Act provides clarity, companies should monitor international developments to avoid illicit finance risks.

- Tax Implications: Consult with legal experts on capital gains, reporting requirements, and jurisdiction-specific rules.

Start by conducting a regulatory audit with legal counsel specializing in digital assets. For U.S.-based firms, align with Treasury’s Advanced Notice of Proposed Rulemaking on stablecoins.

2. Select the Right Crypto Assets

Choosing assets depends on your company’s risk tolerance and objectives. Bitcoin remains the gold standard for store-of-value, while altcoins like Ethereum and Solana offer additional utilities.

Bitcoin vs. Altcoins:

- Bitcoin (BTC): Ideal for hedging and long-term holding. Its market dominance and ETF approvals make it accessible for corporates.

- Ethereum (ETH): Offers staking yields (typically 3-5% annually) and exposure to DeFi. Institutions hold over $40 billion in ETH for its liquidity and growth potential.

- Solana (SOL): Known for high-speed transactions and lower fees, suitable for companies exploring blockchain applications beyond storage.

Diversify to mitigate volatility—aim for a mix where Bitcoin comprises 60-70% of holdings, with altcoins providing yield.

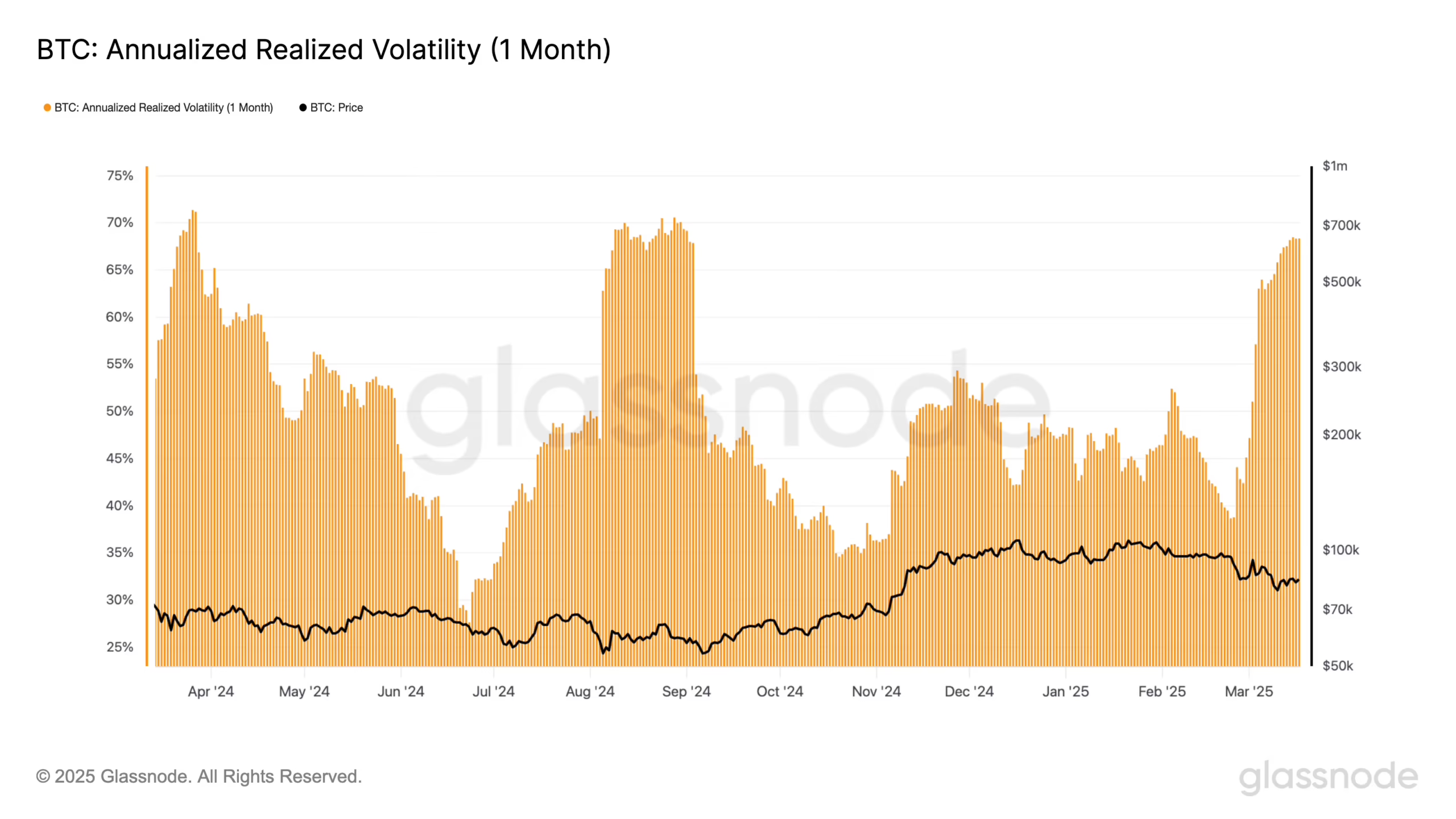

Here’s a chart depicting annualized realized volatility for Bitcoin in 2025, overlaid with price movements:

Source: CoinDesk – BTC’s Most Volatile Day in 2025

This illustrates how volatility peaks during market swings, underscoring the need for strategic asset selection.

3. Set Up Wallets and Security Measures

Security is paramount—crypto hacks can wipe out holdings overnight. Opt for institutional-grade solutions:

- Custody Providers: Use platforms like Fireblocks or BitGo for multi-signature wallets and insurance.

- Best Practices: Implement hardware wallets for cold storage, regular audits, and employee training on phishing risks.

- Governance: Establish robust controls, including multi-party computation (MPC) for key management.

Prioritize liquidity while maintaining security—keep a portion in hot wallets for quick access.

4. Adhere to Accounting Standards

The FASB’s ASU 2023-08 mandates fair value accounting for crypto assets, requiring measurement at each reporting period with changes recognized in earnings.

- Presentation: Report crypto separately from other intangible assets on the balance sheet.

- Disclosures: Provide details on holdings, fair value changes, and risks.

- IFRS vs. US GAAP: Under IFRS, treatment may differ; consult PwC’s Crypto Assets Guide for nuances.

Integrate crypto accounting into your ERP systems for real-time tracking.

5. Integrate with Traditional Finance Tools

Seamlessly blend crypto with existing treasury operations:

- Treasury Management Systems (TMS): Use tools like Kyriba or SAP that support crypto tracking.

- On/Off Ramps: Partner with exchanges like Coinbase Institutional for fiat conversions.

- Liquidity Management: Maintain cash flow by staking ETH or using BTC-backed loans.

Adapt to market conditions—diversify portfolios and monitor volatility.

For a multi-asset volatility perspective, view this chart comparing BTC, ETH, SOL, XRP, and ADA in early 2025:

Source: BlockScholes – Volatility Review February 2025

Real-World Examples of Corporate Crypto Treasuries

Learning from pioneers can accelerate your strategy. Here are two standout cases from 2025.

CleanSpark’s Bitcoin Milestone

CleanSpark, America’s Bitcoin miner, has amassed 13,011 BTC as of September 2025, valued at approximately $1.6 billion. By focusing on sustainable mining and holding mined BTC, CleanSpark has turned volatility into an asset. Their strategy emphasizes efficiency and long-term holding, with monthly production updates showing consistent growth. This approach has differentiated them in the digital asset ecosystem, attracting investors seeking exposure to Bitcoin without direct mining risks.

BitMine’s Ethereum Stash

BitMine Immersion Technologies leads in Ethereum treasuries, holding 2.83 million ETH (over $13 billion) as of October 2025. Recently adding $823 million in ETH, BitMine aims for 5% of total ETH supply. Their focus on Ethereum’s yield potential through staking has boosted treasury returns, surpassing competitors like Marathon Digital. This positions BitMine as a key player in the ETH ecosystem, demonstrating how altcoins can enhance corporate finance.

Insights from Treasury Experts

To provide deeper perspective, we draw from recent interviews with industry leaders.

Torbjørn Bull Jenssen, CEO of K33: “Bitcoin’s role as a form of money is evolving. Treasury strategies should focus on disciplined adoption, aligning with legal and accounting frameworks to mitigate risks.”

Arthur Hayes, Crypto Strategist: “Global liquidity and digital asset treasuries are key for 2025. Companies should leverage flexible strategies for outsize returns in bullish markets.”

Georgii Verbitskii, Forbes Contributor: “Adopting Bitcoin treasuries introduces new rewards but also risks. MicroStrategy’s model shows how it can reshape finance, but volatility demands caution.”

These experts emphasize education and strategic planning amid crypto’s mainstream integration.

Checklist for Executives: Getting Started

Use this checklist to kickstart your crypto treasury:

- Evaluate your company’s risk appetite and objectives.

- Conduct a regulatory and tax compliance review.

- Select assets based on diversification needs (e.g., 60% BTC, 40% ETH).

- Choose secure custody solutions and implement governance.

- Update accounting policies per FASB standards.

- Integrate with TMS and monitor liquidity.

- Start small—pilot with 1-5% of treasury assets.

- Regularly audit and adjust for market changes.

Future-Proofing Your Crypto Treasury

As crypto evolves, stay agile:

- Monitor Regulations: Track updates like the GENIUS Act expansions.

- Diversify Beyond Holdings: Explore DeFi for yields or NFTs for IP.

- Risk Mitigation: Use derivatives for hedging volatility.

- Sustainability: Prioritize green mining and energy-efficient assets.

- Education: Train teams and engage stakeholders for buy-in.

By 2025’s end, corporate crypto treasuries could hold trillions, driven by ETF inflows and adoption. Position your company as a leader by starting today.

This guide serves as a reference for business professionals navigating the crypto landscape. Share it in finance communities to spark discussions and drive informed decisions.