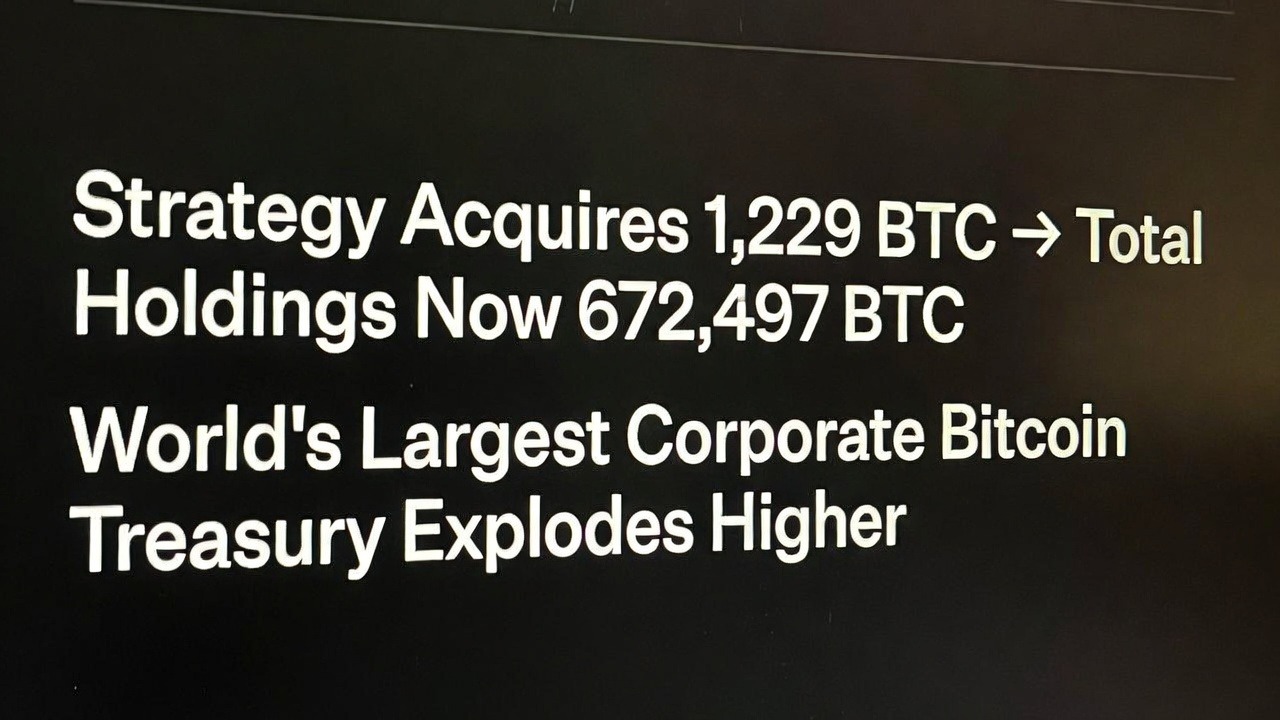

Strategy Inc. has boosted its Bitcoin holdings to a whopping 672,497 BTC after acquiring an additional 1,229 coins.

672,497 BTC: Strategy’s Epic Bitcoin Stash Hits New Heights!

Boom! Just when you thought the corporate Bitcoin rush couldn’t get any wilder, Strategy Inc. drops a bombshell press release announcing their latest crypto haul. The business intelligence giant snapped up 1,229 BTC for about $108.8 million, paying roughly $88,568 per coin. This power move pushes their total holdings to an eye-popping 672,497 Bitcoin, acquired over time for around $50.44 billion at an average price of $74,997 per BTC. Talk about playing the long game—their BTC yield is clocking in at 23.2% year-to-date in 2025 (as of near year-end on December 29)!

As of this writing, with Bitcoin trading around $89,500 per coin, Strategy’s treasury is valued at approximately $60.2 billion. That’s not just a balance sheet booster; it’s a full-on Bitcoin empire. For context, that’s more BTC than most nations or funds even dream of holding. Strategy, rebranded from MicroStrategy and led by visionary founder Michael Saylor, continues to double down on crypto as a core treasury asset. If you’re new to this saga, check out our earlier pieces on Strategy’s transformation into a Bitcoin treasury leader and how Japan’s Metaplanet is following suit with its own BTC stacking strategy.

What This Means for Corporate Crypto Adoption

Strategy isn’t just hoarding digital gold—they’re rewriting the playbook for how public companies handle reserves. Founded in 1989 as a data analytics firm, Strategy has evolved into the world’s largest Bitcoin treasury company while still delivering top-tier AI-powered business intelligence software. With over 1,500 employees and a market cap of about $45.6 billion, they’re proving that crypto and traditional tech can supercharge each other.

That said, the strategy isn’t without risks. S&P Global Ratings recently reaffirmed its ‘B-‘ credit rating for Strategy, pointing to the high volatility and concentration in Bitcoin holdings. [](grok_render_citation_card_json={“cardIds”:[“2a0be3”]}) Stakeholders have voiced concerns about potential black swan events, such as regulatory crackdowns or market crashes, that could adversely affect the company’s balance sheet. [](grok_render_citation_card_json={“cardIds”:[“bc7478″,”c8dca2”]})

This latest buy comes amid a broader wave of corporate interest in Bitcoin as an inflation hedge and growth accelerator. Companies are ditching sleepy cash piles for the volatility (and potential upside) of BTC. Strategy’s approach? Buy consistently, hold forever, and leverage their holdings to fuel expansion. It’s high-octane finance at its finest—casual for the boardroom, thrilling for the markets.

How the Market Reacted When Others Did This

History shows these announcements can ignite fireworks in stock prices, but results vary like a rollercoaster. Back in 2021, when Tesla revealed its $1.5 billion Bitcoin buy, shares surged over 20% in a single day before settling into a wild ride (they later sold most of it). GameStop jumped 12% on its crypto treasury news in 2025, peaking higher amid the hype. Many firms have seen double-digit pops post-announcement, as markets price in the Bitcoin exposure premium.

But it’s not all moonshots—some plays fizzle. Nakamoto Holdings tanked over 96% after its Bitcoin treasury push went south amid market downturns. Even Strategy’s own stock (NASDAQ: MSTR) has swung wildly with BTC’s ups and downs, trading at around $158.81 as of this writing. The key takeaway? These moves amplify volatility, rewarding bold holders but punishing the faint-hearted. No crystal ball here, just pure market adrenaline.

Why Strategy’s Move Matters Now

In a world where inflation lingers and fiat feels fragile, Strategy’s relentless accumulation screams confidence. They’re not waiting for perfect conditions—they’re creating them. This filing underscores a shift: Bitcoin isn’t just for speculators anymore; it’s corporate strategy 101. Whether you’re a shareholder, crypto enthusiast, or curious onlooker, keep an eye on MSTR—it’s like owning a piece of the Bitcoin revolution without touching a wallet.

Stay tuned as more companies join the treasury game. Who knows? Your favorite stock might be next to go full crypto mode.