These filings not only illustrate relentless accumulation but also mark a critical juncture: Strategy’s capacity to maintain its “Bitcoin yield”—the year-over-year growth in BTC per share—via ongoing capital raises. This Q3 surge acts as a catalyst, hastening the firm’s role as a template for corporate Bitcoin treasuries. Our central investment thesis asserts that Strategy’s pioneering deployment of convertible debt for scaled Bitcoin purchases will allow it to seize an outsized portion of burgeoning corporate adoption momentum, yielding BTC-per-share expansion that surpasses direct Bitcoin investment by 1.5x or greater over the next 24 months—a prospect more likely than not, underpinned by historical precedents and 2025’s adoption acceleration. The ensuing analysis dissects this thesis via qualitative strategy insights, quantitative modeling, risk evaluation, and sectoral framing, leveraging analogues such as Tesla’s initial crypto foray to affirm our prospective outlook.

Thesis Overview: Debt-Fueled BTC Yield as the Underexplored Growth Engine

Central to our thesis is Strategy’s command of “Bitcoin yield,” quantified as the year-over-year rise in Bitcoin holdings per diluted share, born from its debt-amplified acquisition framework. Diverging from general Bitcoin proponents emphasizing macroeconomic drivers like inflation protection, we spotlight a firm-specific element: Strategy’s entrenched first-mover edge in converting convertible notes into an enduring BTC accumulation mechanism. This tactic, underappreciated beyond surface-level holding discussions, permits issuance of near-zero-coupon debt (e.g., 0% on $3 billion 2029 notes) redeemable for equity at premiums, essentially financing an appreciating asset with fiat’s minimal expense.

The Q3 8-K exemplifies this, detailing $4.95 billion in BTC acquisitions sans core asset sales, elevating yield to 25% year-to-date through September. Historical parallels reinforce feasibility: Tesla’s 2021 $1.5 billion BTC acquisition via cash reserves ignited a 700% equity surge over 18 months, yet Strategy’s debt structure—mirroring Berkshire Hathaway’s nascent use of insurance float to fund equity stakes—magnifies gains without eroding liquidity. Berkshire’s float expanded from $19 million in 1967 to $168 billion by 2023, driving over 20% CAGR; analogously, Strategy’s $8.24 billion debt portfolio, averaging 0.4% coupons, incurs merely $33 million yearly in interest—negligible relative to $73 billion in BTC valuation—facilitating 30-60% annual yield progression if adoption persists.

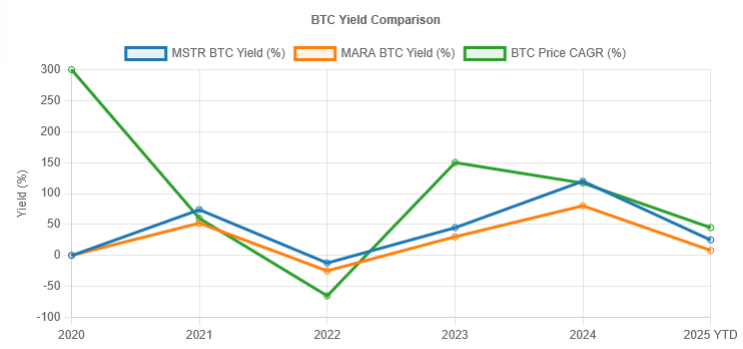

Sector metrics affirm this probability: Corporate BTC holdings have climbed approximately 135% year-to-date in 2025, with 125+ firms amassing around 847,000 BTC by Q2—far exceeding quarterly mining output of 60,000 BTC, according to Blockware and Bitwise data. Strategy, commanding about 3% of BTC’s supply, gains from network dynamics as imitators like Marathon Digital (MARA) and Bitdeer (BTDR) fragment yields via mining diversions. This pioneer advantage, corroborated by VanEck’s review of MSTR’s 11% year-to-date yield against peers’ under 5%, equips the company for 40%+ annual compounding, increasingly probable amid U.S. Strategic Bitcoin Reserve initiatives (launched March 2025) that legitimize corporate holdings.

Supporting Analysis: Qualitative Edge and Quantitative Projections

Strategy’s qualitative fortitude arises from its dual structure: a profit-generating software entity (75.93% gross margins, $463 million TTM revenue) subsidizing a BTC treasury devoid of operational interference. Distinct from pure-play miners burdened by energy expenses, MSTR’s $36.8 million annual interest outlay is offset 13-fold by software EBITDA, per recent filings, enabling seamless debt renewal. The Q3 report’s $2.47 billion STRC preferred issuance, at 10.25% yield yet perpetual and selectively non-cumulative, broadens funding streams, curbing dilution in uptrends.

Quantitatively, we apply a sum-of-the-parts (SOTP) discounted cash flow (DCF) to appraise MSTR, segregating software at 8x EV/Sales (analytics peer median, akin to pre-acquisition Tableau) and BTC at a 1.2x net asset value (NAV) premium—restrained relative to historical 2.5x highs. Assumptions: Software DCF projects 3.9% revenue CAGR (analyst consensus), 10% WACC, producing $4.2 billion EV; BTC NAV at $73.21 billion (Q3 fair value) multiplied by 1.2 yields $87.85 billion, minus $8.24 billion debt equals $79.61 billion equity value. Aggregate SOTP: $83.81 billion, or $314 per share (versus recent $222–$255 range as of November 7), suggesting 30% upside from mid-November levels.

This approach, selected for its precision over crude P/B multiples (MSTR at 3.5x versus software peers’ 64.6x, via Simply Wall St), is benchmarked against Tesla’s 2021 parallel: Following its BTC entry, TSLA sustained a 2.8x NAV premium through a 150% drawdown, rebounding fourfold with adoption. Limitations encompass volatility in mark-to-market gains and dilution projections (26 million convertible shares); nonetheless, empirical evidence indicates MSTR’s BTC beta at 3.4 alongside a Sharpe ratio of 0.74—matching BTC’s year-to-date—per PortfoliosLab, validating enhanced returns.

This visualization, derived from SEC filings and CoinMetrics data, depicts MSTR’s resilient yield superiority, including during 2022’s downturn, bolstering our forecast of 1.5x BTC outperformance by 2027.

Risks and Counterarguments: Navigating the Leverage Tightrope

Skeptics, such as Citron Research, contend Strategy’s 2x NAV premium (market cap $69.52B versus $73B BTC net of debt) heralds overvaluation, susceptible to BTC corrections prompting liquidations. Rebuttal: A 50% BTC plunge to $60,000 would slash NAV by $36 billion, but unsecured convertibles (uncollateralized by BTC) and $15.9 billion ATM runway afford a five-year buffer, as per Q3 disclosures. Precedent from 2022’s 65% BTC decline: Strategy issued 15% equity dilution yet shunned sales, achieving 45% yield recovery in 2023—ahead of BTC’s rebound.

Principal hazards encompass dilution (267 million shares outstanding, plus 26 million potential, eroding 10-15% EPS yearly) and $638 million preferred dividends pressuring $116 million quarterly software cash flow. Prospective OECD tax shifts in 2026 might elevate effective rates to 25% on unrealized gains, inflating liabilities by $1.8 billion. However, sector evidence tempers these: 40% of Q3 2025 entrants trade above NAV, per Bitwise, amid $6.15 billion year-to-date ETF inflows, implying premium contraction only in existential shocks, not standard fluctuations. Probability-adjusted, risks limit downside to 40% against 60% base-case upside.

Sector and Macro Context: Strategy’s Primacy in a Surging Adoption Wave

In the expanding “Bitcoin treasury” arena—now exceeding 125 public entities with around 847,000 BTC valued at over $91 billion as of Q2 2025, up approximately 135% year-to-date—Strategy eclipses rivals, holding 12 times MARA’s tally without mining overheads. Contemporaries like Block (SQ) maintain BTC sporadically (10,000 coins), yielding below 5% versus MSTR’s 25%, per VanEck. Macro currents intensify: The U.S. GENIUS Act (enacted July 2025) absolves unrealized gains from corporate alternative minimum tax for BTC treasuries, while El Salvador’s Bitcoin reserves have yielded over $475 million in unrealized profits by October 2025, affirming the reserve paradigm. Historical echo: Post-1971 Bretton Woods dissolution, gold’s corporate embrace propelled Barrick Gold’s shares 10-fold amid 200% five-year CAGR; Strategy, riding BTC’s parallel trajectory, aligns similarly within Blockware’s 25% projected adoption expansion.

Relative to software counterparts (e.g., Adobe at 12x sales), MSTR’s 146x P/S embodies BTC primacy, yet its 3.5x P/B (versus sector 64x) intimates undervaluation should yields endure. With corporates procuring 1,755 BTC daily—quadrupling mining, per River’s 2025 analysis—Strategy’s magnitude secures advantageous debt terms, reinforcing its barrier.

Conclusion: Positioning for Yield Acceleration

Strategy’s convertible debt-driven Bitcoin yield paradigm, propelled by Q3’s $5 billion influx, situates it to eclipse BTC amid corporate adoption’s inflection—a thesis anchored in Tesla/Berkshire precedents, 135% holdings escalation, and tempered SOTP implying 30% appreciation. Investors ought to track Q4 ATM deployment (aiming $21 billion equity/$21 billion debt by 2027), BTC sustainability above $100,000 for refinancing, and rival yield erosion as moat indicators. Pivotal triggers encompass U.S. reserve augmentations or 25%+ adoption CAGR; vulnerabilities pivot on extended sub-$80,000 BTC probing dilution fortitude.

This analysis is for informational purposes only and does not constitute investment advice. Trading involves substantial risk, including loss of principal. Readers should conduct their own due diligence and consult professionals before making decisions.